Republican’s Flat Tax Nothing but a Boondoggle for the Rich

Wisconsin’s Republican leaders just can’t help themselves.

In November voters rejected a flat income tax when its proponent, Tim Michels, lost to Gov. Tony Evers. However, schemes to make the rich richer are the GOP’s trademark, so now Senate Majority Leader Devin LeMahieu has proposed eliminating the state’s mildly progressive income tax and replacing it with a 3.25% flat tax by 2026.

No matter how they try to package it, the flat tax would accomplish only two things: drastically deteriorate our quality of life in Wisconsin and, yes, provide a windfall for the super wealthy.

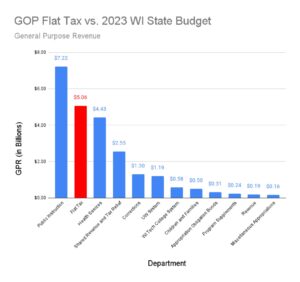

According to the nonpartisan Legislative Fiscal Bureau, when fully implemented the flat tax would reduce the state’s revenue by $5.06 billion annually. For perspective, the UW System’s share of general purpose revenue in 2023 is $1.3 billion. The Department of Corrections also receives $1.3 billion. The total of $2.6 billion is slightly more than half (51%) the total tax cut. To put it another way, you could eliminate all state funding for corrections and the UW system, and still need to cut another $2.46 billion in state spending to pay for the tax cut. (Data from(2021-23 Budget in Brief )

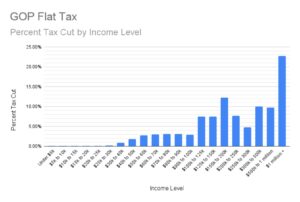

(Chart: Percent Tax Cut by Income Level)

A group of national economists analyzed Michels’ flat tax proposal in October and wrote that a 3.54% flat tax, “…would mean draconian cuts to state services including public safety, K-12 education, environmental protection, the University of Wisconsin and Technical College systems.” Yet LaMahieu’s proposal would slash even more from state revenue.

This is a completely irresponsible proposal at a time when 95% of the state’s cities, villages, towns and counties are struggling financially because the state has slashed shared revenue with local government.

Kansas offers the perfect example of damage from deep tax cuts. In 2012 it slashed its top income tax rate by almost 30% and cut the rate on certain business profits to zero. Republicans promoted these cuts as “a shot of adrenaline into the heart of the Kansas economy stimulating strong growth in economic output, job creation, and new business formation.” The results, however, were just the opposite . (Center on Budget and Policy Priorities, “Kansas Provides Compelling Evidence of Failure of “Supply-Side” Tax Cuts,” 2018).

The only way Wisconsin could avoid severe cuts to public services would be to dramatically increase state sales taxes, but since they are regressive taxes, this would shift even more of the tax burden from the rich to the poor.

Wisconsin has its own example of the failure of tax cuts for the super-rich , also known as “supply-side economics.” Former Gov. Scott Walker slashed taxes on the wealthy at the same time that Minnesota Governor Mark Dayton raised taxes on the rich. The result? Minnesota had stronger job growth and experienced greater growth in median household income than Wisconsin. In Minnesota poverty rates declined while in Wisconsin poverty increased. (Economic Policy Institute, “As Wisconsin’s and Minnesota’s lawmakers took divergent paths, so did their economies,” 2018).

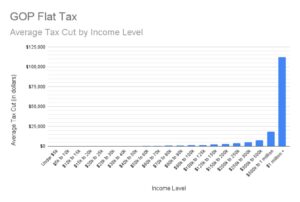

Let’s look at who would benefit most from the GOP scheme. Only 0.4% of Wisconsinites make $1 million a year. Under LeMahieau’s plan, they would be gifted an average tax cut of $112,167 per year! Those making $500,000 to $1 million, 1% of all filers, would receive $18,269 a year. In total, the richest 1.4% in our state would pocket fully one-third of the flat-tax bonanza, including people like Diane Hendricks and Richard and Elizabeth Uihlein, the largest contributors to Republican campaigns. These dots are clearly connected.

How about the working poor and middle class who make up the vast majority of Badger state citizens? Workers making between $40,000 and $50,000 would see only a measly tax cut of $290 annually. In fact, the 70% of taxpayers making under $100,000, would receive only 17.8% of the total tax cut. Does that sound fair or wise?

(Chart: Average Tax Cut by Income Level)

Now flat-tax advocates make up all kinds of justifications for this boondoggle. One is that we need to lower the tax rate to keep people from leaving the state. This ignores the fact that seniors relocate for a variety of reasons, including to escape Wisconsin winters and to be closer to their children and grandchildren.

Think about how attractive Wisconsin will be to seniors or anybody else after our state has lacerated its spending on roads, education, public safety, clean water and air. Then raise your hand if you want to decimate our quality of life in an attempt to keep rich folks from relocating to Florida and Arizona.

Instead of repeated attempts to carry water for Wisconsin’s richest 1.4%, Republican politicians should focus on boosting the quality of our lives by improving our education systems and infrastructure while developing targeted policies to encourage entrepreneurship, rural development, and a more diversified economic base.

The flat tax is a bad idea. It has been rejected by Wisconsin taxpayers. Gov. Evers should veto it if it gets to his desk.

Michael Rosen taught Economics and Charlie Dee taught American Studies at the Milwaukee Area Technical College Both are retired members of the Wisconsin American Federation of Teachers.

This article originally appeared in the Milwaukee Journal Sentinel January 29, 2023. Reprinted with permission.